Factsheet: Corporate Reporting Standards and Requirements

Key Takeaways

- Rapid increase in the number of corporate reporting standards and requirements aimed at raising transparency and accountability and ultimately improving corporate performance.

- Reporting requirements cover, among other things, climate- and nature-related financial disclosures, environmental and social sustainability along the value chain, strategy and stress testing.

- Insights and lessons learnt are useful for non-corporates such as local governments as well and could help to better address challenges.

There has recently been a proliferation of corporate reporting standards and requirements in the UK and abroad. These new standards and requirements are aimed at raising transparency and accountability and ultimately corporate performance. This factsheet presents some of the key recent and on-going developments.

Financial reporting

Climate-related financial disclosures

The Task Force on Climate-related Financial Disclosures (TCFD) presented its recommendations in June 2017 with the expectation that jurisdictions globally would adopt them. In 2021 the G7 nations agreed to make the disclosures mandatory, with the UK becoming the first G20 country to adopt them.

Since 2022 most large UK companies and LLPs, including banks, insurers, pension schemes and asset managers and owners report climate-related financial information in their non-financial and sustainability information statement as part of their Strategic Report. Where no Strategic Report is being prepared, the information will need to be disclosed in an Energy and Carbon Report as part of the Annual Report.

Companies and LLPs within scope have to disclose information on climate-related risks and opportunities, where these are financially material. The disclosures need to address how climate change is addressed in corporate governance; how it might impact strategy; how related risks and opportunities are managed; and the performance measures and targets applied in managing these issues.

Nature-related financial disclosures

In September 2023 the Taskforce on Nature-related Financial Disclosures published its recommendations to complement the 2017 climate recommendations. The taskforce has started discussions with jurisdictions on adoption and has stated that the recommendations are suitable for organisations of all sizes, sectors and value chains.

The recommendations set out the suggested disclosure framework and 14 desirable disclosures. They are consistent with the language, structure and approach of both the TCFD and the International Sustainability Standards Board (ISSB) to enable integrated climate- and nature-related reporting.

Of the 14 recommended disclosures three deal with governance; four with strategy; four with risk and impact management; and three with metrics and targets.

Non-financial reporting

Corporate Sustainability Reporting

In January 2023 the EU Corporate Sustainability Reporting Directive (CSRD) entered into force. Companies subject to the CSRD will have to report according to European Sustainability Reporting Standards. These standards take a ‘double materiality’ perspective, in other words companies will need to report on how environmental and social issues might create financial risks and opportunities for the business and how the business might impact on the environment and society

The standards require 12 disclosures on issues such as climate, pollution, water and marine resources, biodiversity, circular economy, own workforce, affected communities and business conduct. The EU Corporate Sustainability Reporting Directive is closely aligned with the ISSB’s International Financial Reporting Standards (IFRS) S1 and S2.

The UK government is currently working on its own corporate sustainability disclosure standards, which should also be closed aligned with (and based on) the IFRS. In July 2023 the UK Financial Reporting Council called for evidence on UK endorsement of IFRS S1 and S2. The UK sustainability standards might come into force in 2025. In January 2024 the UK Financial Reporting Council published its UK Corporate Governance Code 2024, updating the current 2018 code, covering companies with a premium listing on the London Stock Exchange.

Corporate Due Diligence

The EU is also in the process of implementing its Corporate Sustainability Due Diligence Directive (CSDDD). The CSDDD establishes a comprehensive framework for larger companies operating in the EU of corporate due diligence to identify actual or potential risks to human rights and the environment and establish mitigating actions. The rules would apply to the entire (potentially global) upstream and downstream value chain. The directive will come into force this year.

In June 2023 an early motion on “Potential merits of new legislation on mandatory corporate due diligence” was tabled in the House of Commons, pointing out that similar laws were being introduced in other countries and that the UK government should adopt such law as soon as possible. In November 2023 a Bill proposing the Commercial Organisations and Public Authorities Duty (Human Rights and Environment) Act was introduced to the House of Lords.

Strategic Report and Directors’ Report (Amendment) Regulations 2023

The UK Parliament is currently debating the Draft Companies (Strategic Report and Directors’ Report) (Amendment) Regulations 2023. If approved, it would apply to UK companies with at least 750 employees and an annual turnover of at least £750 million and would comprise an annual resilience statement, and annual distributable profits figure and an annual material fraud statement.

In the annual resilience statement companies would be required to explain the steps they are taking to build or maintain their business resilience over the short, medium and long term. This would include a summary of the company’s strategic approach to managing risk and building or maintaining business resilience (including how risk and resilience are considered within the company’s business planning and investment cycle, and within relevant internal governance processes); a description of the main risks; a reverse stress test identifying mitigating actions to deal with potential adverse circumstances; and a summary of long-term trends or factors that could threaten the business model or operations.

Transition Plan

In April 2022 HM Treasury launched the Transition Plan Taskforce to develop “the gold standard for private sector climate transition plans”. In October 2023 the taskforce published its suggested disclosure framework, which is designed to be consistent with and builds on the climate-related disclosure standards (IFRS2) issue by the International Sustainability Standards Board (ISSB) in June 2023

The framework identifies five elements of a good practice transition plan: foundations (strategic ambition of the plan); implementation Strategy (actions taken to achieve its strategic ambition, as well as the resulting implications for its financial position, financial performance, and cash flows); engagement strategy (with regards value chain, industry peers, government, public sector, communities, and civil society); metrics and targets (used to drive and monitor progress towards strategic ambition); and governance (how is transition plan embedded in governance structures and organisational arrangements).

Why does it matter?

Corporate reporting standards and requirements aim to improve transparency and accountability and ultimately help businesses perform better, for example by identifying key risks and developing mitigating actions. Corporate reporting requirements could therefore also provide insights and lessons for non-corporates such as local governments.

If you would like to find out more about the topics discussed in this factsheet and what insights and lessons you could take away from corporate reporting requirements to address the challenges you face, please talk to us.

Suggested further reading

Further suggested reading

(external links, accessed 26 January 2024)

Task Force on Climate-Related Financial Disclosures

Taskforce on Nature-related Financial Disclosures

The Companies (Strategic Report and Directors’ Report) (Amendment) Regulations 2023 (UK Parliament)

UK Corporate Governance Code 2024 (Effective 2025) (UK Financial Reporting Council)

EU Corporate Sustainability Reporting Directive (European Commission)

Corporate Sustainability Reporting (EU lex)

Disclosure Framework (Transition Plan Taskforce)

International Sustainability Standards Board

Global Sustainability Standards Boards

Symposium on Developing Public Sector Sustainability Reporting Standards (World Investment Forum)

England Population

Local Government Capital Expenditure and Stock

Public-sector Employment and Wage Trends

Climate Change

Factsheet: Public-sector Employment and Wage Trends

Key Takeaways

- The share of public-sector employment in total employment has been relatively stable once reclassification effects are taken into account. In 2023 around 17% of the total workforce worked in the public sector. With NHS employment rising, the share of central government employment in public-sector employment is on the increase.

- Since mid-2021 average weekly earnings have been higher in the private than in the public sector. Since the beginning of the century this has only otherwise been the case in 2000. Moreover, there has been a compression of pay within the public sector. Historically average weekly earnings have been higher in the public than in the private sector as educational attainment and skills are generally higher in the former.

- Between mid-2021 and mid-2023 public-sector real wage growth was negative, with the result that real average weekly earnings have still not returned to pre-Covid levels. By contrast, real average weekly earnings in the private sector have been higher than pre-Covid with the exception of the furlough period in 2020.

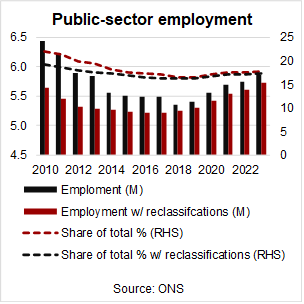

The share of public-sector employment in total employment has been relatively stable once reclassification effects are taken into account

The share of public-sector employment in total UK employment dropped from 22% in 2010 to around 16.5% in 2018 and has since only gradually increased again. In absolute numbers public-sector employment was – at 5.9m – around 560,000 lower in 2023 than in 2010.

However, these headline changes reflect more sectoral reclassifications than actual trends. Among other reclassification changes, Further Education and Sixth Form College corporations in England were included in the public sector before mid-20212 but have been included in the private sector since then. Going the other way, Lloyds Banking Group plc and Royal Mail plc were reclassified from the public to the private sector at the end 2013. Once these reclassification changes are taken into account, the drop in the share of public-sector employment in total employment was much more modest and public-sector employment was in fact marginally higher in absolute terms in 2023 than in 2012.

The share of public-sector employment in total employment varies considerably across the regions of the UK. In 2023, in the East and South East only 15% of the total workforce was employed in the public sector. This contrasts with 26% in Northern Ireland.

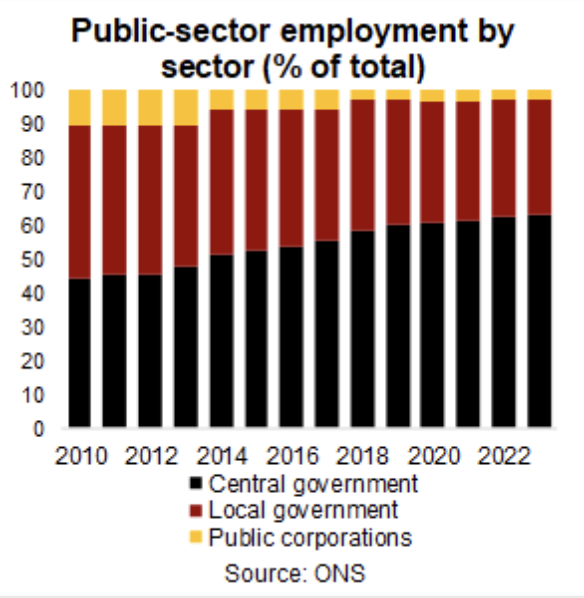

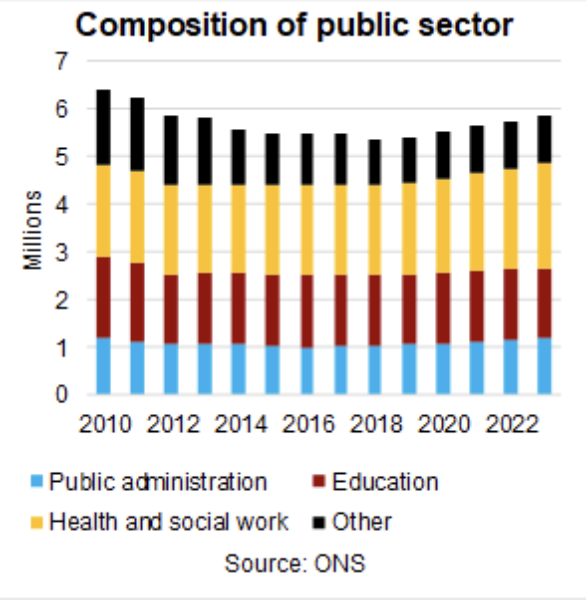

Within the public sector, central government is taking an ever larger employment share, rising from 44% in 2010 to 62% in 2023. Both local government and public corporations saw declines in their shares over that period.

Much of this can be explained by the rapid rise in NHS employment, which went from 1.6m in 2010 to 2m in 2023. By contrast, employment in the civil service and in education remained reasonably stable over that period.

Since mid-2021 earnings have been higher in the private than in the public sector, reversing a long-term trend

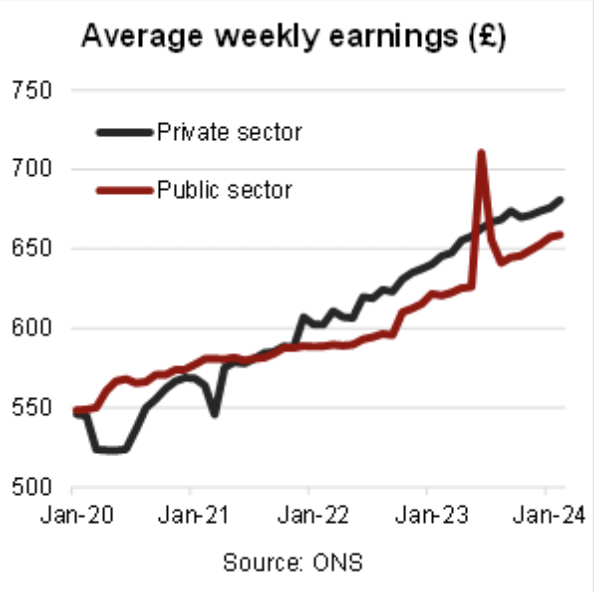

Average weekly earnings in the private sector dropped sharply at the onset of the Covid pandemic in early-2020 when many workers were moved to the government’s furlough employment support scheme. Average weekly earnings recovered quickly though and with the exception of March 2021 (when bonus pay was below trend) has seen steady growth since.

By contrast, average weekly earnings in the public sector continued to grow during the first year of the Covid pandemic but then trended sideways until early-2023. Since then it has grown more or less in line with private-sector earnings (the spike in June 2023 reflects the one-off bonus payment to NHS workers).

Notably, as a result of these diverging trends, average weekly earnings in the private sector have been higher than in the public sector since mid-2021.

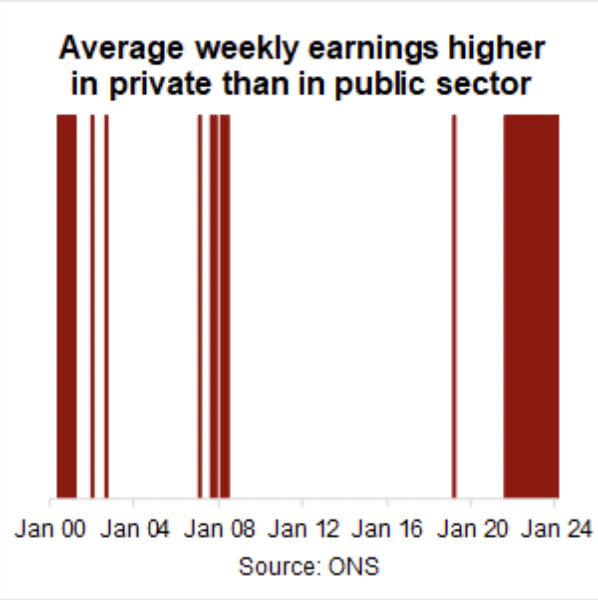

This contrasts with the long-term trend. In the 290 months between January 2000 and February 2024, average weekly earnings in the private sector were higher than in the public sector in only 49 of them (16%) – 30 of which since mid-2021. The last time average weekly earnings in the private sector were higher than in the public sector over several consecutive months was in 2000.

According to the Institute of Fiscal Studies, several professions in the public sector including nurses but in particular teachers and hospital doctors have experienced much worse pay growth than the average public-sector worker. This reflects a (deliberate) compression of public-sector pay within and across professions. This contrasts with developments in the private sector over the same period. Historically average pay in the public sector has been higher than in the private sector as the average level of educational attainment and skills is higher in the former than in the latter.

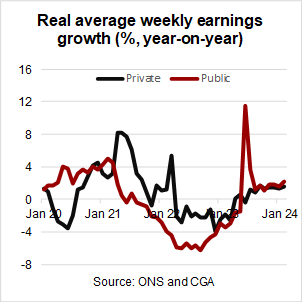

Between mid-2021 and mid-2023 public-sector real wage growth was negative

With consumer price inflation accelerating from early-2021 onwards (taking annual CPIH from 0.8% in December 2020 to a peak of 9.6% in October 2022), moderate nominal average weekly earnings growth initially turned into modest real growth and then negative real growth. This was particularly notable in the public sector: in the 24 months between July 2021 and June 2023, real average weekly earnings growth was negative in 22 of them. In the private sector this was the case in 14 out of those 24 months.

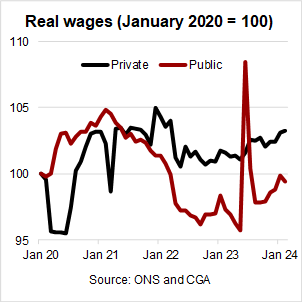

As a result (and ignoring the one-off spike in June 2023), real average weekly earnings in the public sector were well below their pre-Covid level between mid-2022 and late-2023 and are only now close to pre-pandemic levels. This contrasts with developments in the private sector, where real wages have been higher than pre-Covid since the end of the furlough period.

Why does it matter?

Public-sector pay accounts for a large part of the public-sector spending and as such plays an important role in the financial stability of local governments and other public-sector bodies. Recent earnings trends show a compression of public-sector pay within and across professions, with the result that public-sector average weekly earnings have fallen behind those in the private sector. This suggests that public-sector wages in general and for certain professions in particular face significant upward pressure, potentially straining public-sector budgets even further.

If you would like to discuss what insights and lessons you could take away from recent public-sector and private-sector employment and wage trends, please talk to us.

Suggested further reading

UK Public Finances

England Population

Local Government Capital Expenditure and Stock

Corporate Reporting Standards and Requirements

Climate Change

Factsheet: Local Government Capital Expenditure and Stock

Key Takeaways

- In 2022-23 English local authorities spent a third of their capital expenditure on housing and about a quarter on highways and transport. In 2022-23 capital expenditure, which was down by 7% in real terms on 2018-19, was mainly used for new constructions, conversion and renovations.

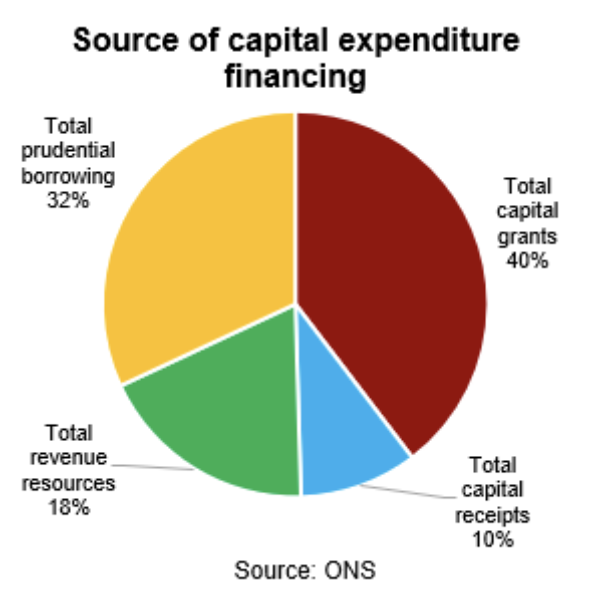

- The main source of revenue to finance capital expenditure were capital grants, followed by prudential borrowing. The sources of revenue have remained relatively stable between 2018-19 and 2022-23.

- The net capital stock of local government in the UK increased from 8% of GDP in 2000 to 14% of GDP in 2022. Other buildings and other structures make up the bulk of the net capital stock.

Capital expenditure by service

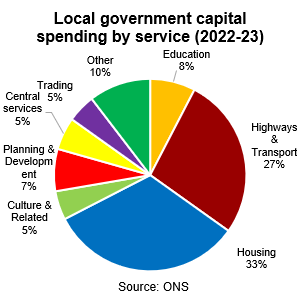

In Fiscal Year (FY) 2022-23 local authorities in England spent £27.5bn on capital expenditure. Of this spending, a third was on housing, just more than a quarter on roads and transport, and just less than a tenth on education. Planning and development services, central services, culture and related services and trading (i.e. the maintenance of civic halls, retail markets and industrial estates etc) together made up nearly a quarter, with the rest spread across services such as police, environment and fire and rescue.

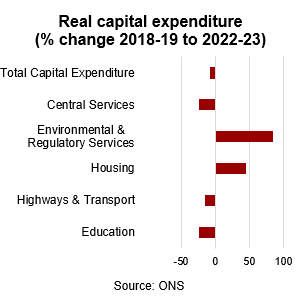

In real terms, the £27.5bn spent on capital expenditure in FY2022-23 represents a 7% decline from the 2018-19 level, with capital spending on education and central services falling by nearly a quarter. Local government capital spending on highways and transport dropped only slightly less (-15.3%). By contrast, local government capital spending on housing increased by nearly 50%, taking its share from 20% of the total in 2018-19 to a third in 2022-23.

Capital expenditure by category

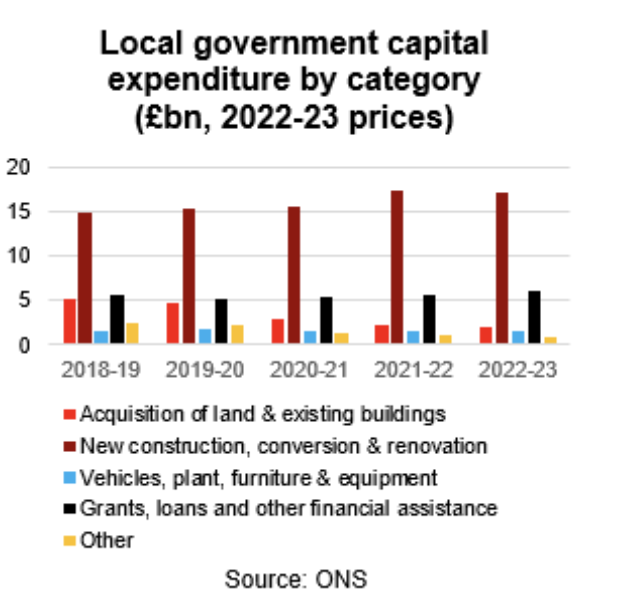

Of the £27.5bn spent in FY 2022-23, £17.2bn was spent on new construction, conversions and renovations, a further £1.9bn on the acquisition of land and existing buildings and £1.6bn on the purchase of vehicles, plant, furniture and other equipment. £6bn was given in the form of grants, loans and other financial assistance to other organisations to invest on behalf of the local authorities.

Over the period 2018-19 to 2022-23, the most notable development was the decline in investment in land and existing buildings. Amounting to £5bn in 2018-19, this more than halved over the following years, explaining the overall decline in local authority capital expenditure.

Revenue sources

The capital expenditure and revenue statistics do not fully match up, with the published expenditure data around £1.5bn lower than the revenue data.

In FY 2022-23, 40% of the resources used to finance capital expenditure came from capital grants, around 20% from revenue resources (including from the housing revenue account, major repairs reserve and CERA) and 10% from capital receipts (incl

uding money received from the selling land, buildings or other capital assets). The remainder – just under a third – was in the form of prudential borrowing. These shares remained relatively stable between 2018-19 and 2022-23.

Local authority net capital stock

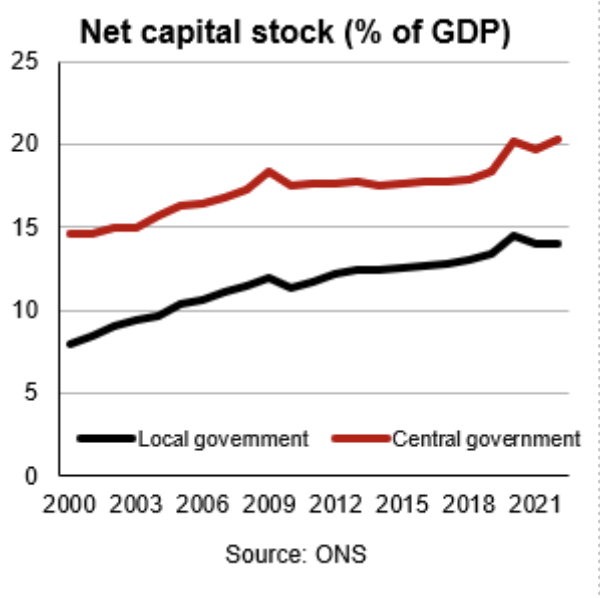

The Office for National Statistics publishes capital stock data for the UK only. As a share of GDP, the net capital stock of local government, that is the market value of fixed assets once deprecation is taken into account, increased from 8% in 2000 to 11% in 2010 and then 14% in 2022.

This is a much more notable increase than that for central government, which increased from 15% in 2000 to 20% in 2022. Other buildings and other structures have made up around 90% of the total net capital stock for local government throughout that period. The remainder is split between land improvements, ICT and other machinery and transport.

Why does it matter?

Local authorities play an important role in providing essential public services such as housing, transportation, and education. Capital expenditure and capital stock trends help to understand how this role is changing over time. Combined with local authority revenue trends they also illustrate the financing gap to be filled by prudential borrowing.

If you would like to discuss what insights and lessons you could take away from local authority capital expenditure and revenue trends in England, please talk to us.

Suggested further reading